Thinking About Buying a Home? Ask Yourself These Questions

If you’re contemplating purchasing a home in the current year, it’s likely that you’re more attentive than usual to the real estate landscape. You’re gathering information from various sources, such as news outlets, social media, your real estate agent, discussions with friends and family, and more. It’s probable that discussions about home prices and mortgage rates are dominating your considerations.

Consider the following key questions as you navigate through your decision-making process, supported by pertinent data to sift through the surrounding information clutter.

1) Where Do I Think Home Prices Are Heading?

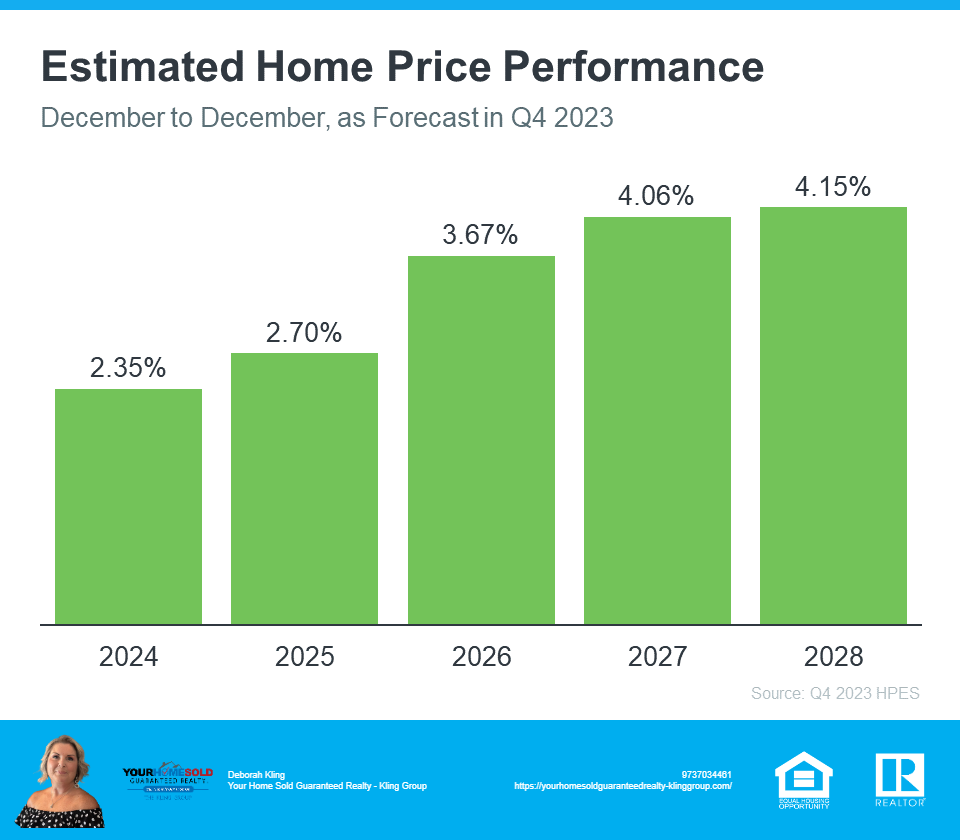

A dependable source for insights into home price forecasts is the Home Price Expectations Survey conducted by Fannie Mae. This survey compiles responses from over one hundred economists, real estate experts, as well as investment and market strategists.

Based on the latest information, the specialists anticipate that home prices will persist in their upward trend at least until 2028, as illustrated in the graph provided below:

This information is significant for you because, although the rate of appreciation might not be as steep as it has been in recent years, the key takeaway from this survey is the projection that home prices are expected to continue rising, rather than declining, for at least the next five years.

The fact that home prices are increasing, albeit at a more moderate rate, is beneficial not just for the market but also for you. This implies that if you purchase a home now, it’s likely to appreciate in value, allowing you to accumulate home equity in the coming years. However, if you choose to delay your purchase, these forecasts suggest that the cost of a home will be higher in the future, making it more expensive for you later on.

2) Where Do I Think Mortgage Rates Are Heading?

Over the past year, mortgage rates spiked up in response to economic uncertainty, inflation, and more. But there’s an encouraging sign for the market and mortgage rates. Inflation is moderating, and here’s why this is such a big deal if you’re looking to buy a home.

When inflation subsides, mortgage rates typically decrease in response, aligning with recent trends. Moreover, with the Federal Reserve indicating a pause in Federal Funds Rate increases and potential rate cuts in 2024, experts are increasingly optimistic about a decline in mortgage rates. Danielle Hale, Chief Economist at Realtor.com, offers further insight:

“. . . mortgage rates will continue to ease in 2024 as inflation improves and Fed rate cuts get closer. . . . a key factor in starting to provide affordability relief to homebuyers.”

As an article from the National Association of Realtors (NAR) says:

“Mortgage rates likely have peaked and are now falling from their recent high of nearly 8%. . . . This likely will improve housing affordability and entice more home buyers to return to the market . . .”

While predicting the exact trajectory of mortgage rates remains uncertain, the recent downturn and the Federal Reserve’s decision to halt rate increases indicate a positive outlook. Although occasional fluctuations may occur, the overall trend suggests improving affordability as rates continue to ease.

Bottom Line

If you’re contemplating a home purchase, staying informed about expected trends in home prices and mortgage rates is crucial. While certainty about their future direction is elusive, having the latest information can empower you to make an informed decision. Let’s connect to ensure you stay updated on current developments and understand why these dynamics are favorable for you.

Thinking About Buying a Home? Ask Yourself These Questions

Thinking About Buying a Home? Ask Yourself These Questions